In today’s fast-paced financial world, staying organized is more important than ever. Payroll check stubs are essential for both employees and employers, offering a transparent breakdown of earnings, deductions, and taxes. But did you know you don’t need to spend a fortune on fancy software or services to create professional, accurate pay stubs? With the right resources, you can create check stubs for free! Here, we’ll unlock the secrets of payroll check stub templates and how they can simplify your financial management.

Why Are Payroll Check Stubs Important?

Before diving into templates, it’s essential to understand the role payroll check stubs play:

- Transparency: They provide a detailed breakdown of gross pay, taxes, deductions, and net pay, ensuring clarity for both employers and employees.

- Record-Keeping: Check stubs act as proof of income and are essential for loan applications, renting apartments, or tracking personal finances.

- Tax Compliance: They help employers and employees maintain accurate records, making tax season less stressful.

Whether you’re a business owner, freelancer, or an employee, having access to accurate payroll check stubs is invaluable.

What Is a Payroll Check Stub Template?

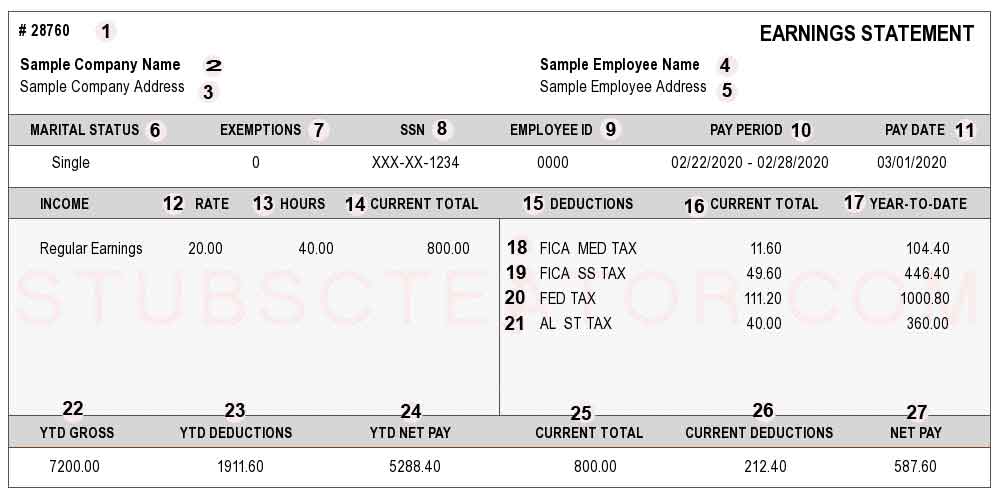

A payroll check stub template is a pre-designed document that simplifies the process of creating pay stubs. These templates typically include:

- Employee Details: Name, address, and ID or employee number.

- Pay Period Information: Dates of the pay period and payment date.

- Earnings Breakdown: Gross wages, overtime, bonuses, and other income sources.

- Deductions: Taxes, insurance, retirement contributions, and other withholdings.

- Net Pay: The final amount received after deductions.

Benefits of Using Free Payroll Check Stub Templates

- Cost-Effective: Why pay for software when you can use free templates?

- Time-Saving: Pre-formatted fields mean you can generate pay stubs in minutes.

- Customization: Many templates allow you to adjust fields to meet your specific needs.

- Accuracy: Automated calculations reduce the risk of errors.

Finding reliable and professional templates doesn’t have to be a challenge. Online Paystubs Generators: Websites like stubscreator.com, pay-stubs.com provide intuitive tools to create stubs directly online.

How to Choose the Right Template

Not all templates are created equal. When selecting a payroll check stub template, consider the following:

- User-Friendly Design: Look for templates that are easy to understand and navigate.

- Customization Options: Ensure the template allows you to adjust fields for taxes, deductions, and other specifics.

- Compliance: Verify that the template meets local tax and labor regulations.

- Professional Appearance: A clean and polished design enhances credibility

Tips for Using Payroll Check Stub Templates Effectively

- Double-Check Calculations: Even with automated features, always review numbers for accuracy.

- Update Regularly: Keep templates updated with current tax rates and regulations.

- Maintain Security: Protect sensitive information by using encrypted files or password protection.

- Stay Organized: Save copies of all generated stubs for future reference.

Creating accurate and professional payroll check stubs doesn’t have to be expensive or complicated. By leveraging free templates and tools, you can save time, reduce costs, and maintain financial accuracy. Whether you’re a small business owner, freelancer, or simply someone managing their finances, these resources are invaluable.

Start exploring free payroll check stub templates today and take control of your financial records. With a bit of practice, you’ll unlock the secrets of streamlined payroll management without spending a dime!