A W-2 form is used to file employee’s federal and state taxes. The w-2 is a record that you earned what you paid taxes from your earnings.

Employers must complete a Form W-2 for each employee to whom they pay a salary, wage, or other compensation as part of the employment relationship.

W-2 form gives the Social Security Administration and the IRS information to verify the employee’s income tax return. W-2 must be filed with the Social Security Administration (SSA) by January 31 of the next year.

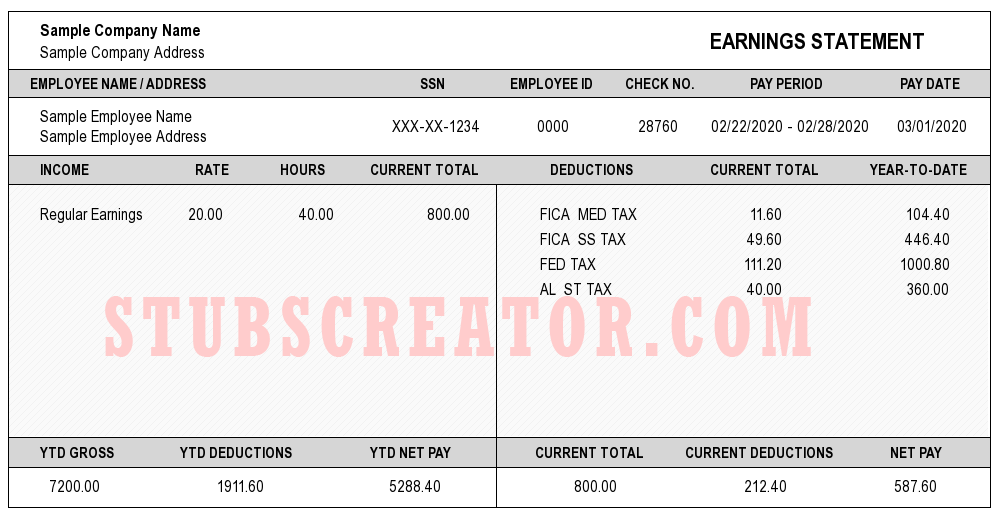

Informations need to complete W-2 Form.

-Information about bussiness

- Employer Identification Number

- Business Name And Address

- Business State Tax ID Number

-Information about Employee

- SSN (Social Security Number)

- Employee Name and Employee Address

-Information about Employee Earnings

- Total Earnings and other compensation

- Total Social Security wages

- Total Medicare wages

- Social Security tips and allocated tips

-Information on Retirement Plans

In W-2 Form Box 12, need to indicate, for each W-2, if each employee participates in a retirement plan or a nonqualified plan with Employer, if an employee is a statutory employee, or if the person received third-party sick pay.

-Information on Special Benefits

Box 13 of the W-2 Form requires information about deductions for employee benefit plans and other deductions that must be reported on the employee’s income tax return.