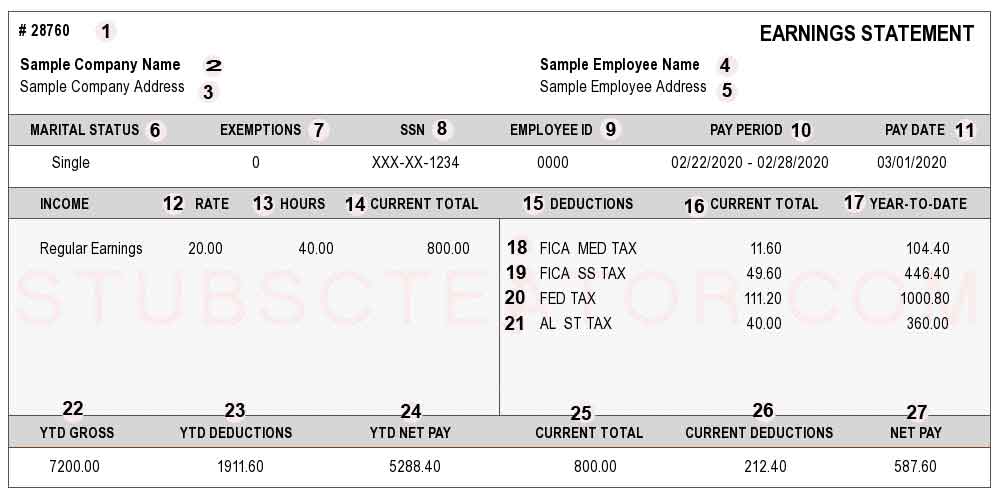

Pay stub is a document paper that show earnings and tax deductions of a earning period. Earning period depends on how are you paid by your employer or employment conditions. Pay period may be Weekly, Bi-Weekly, Semi-Monthly, Monthly, Bi-Monthly, Quarterly and Yearly.

Employer and employee may know about pay stub and pay what should be available on a pay stub document.

- #Check Number

- Company Name

- Company Address

- Employee Name

- Employee Address

- Marital Status

- Exemptions

- Social Security Number

- Employee ID

- Pay Period

- Pay Date

- Rate

- Hours

- Current Total

- Deductions

- Current deductions

- Year To Deductions

- Fica Med Tax

- Fica SS Tax

- Fed Tax

- State Tax

- Year To Date Gross

- Year To Date Deductions

- Year To Date Net Pay

- Current Total

- Current Deductions Total

- Current Net Pay