Whether you’re applying for a loan, verifying income for a rental, or handling tax-related matters, having access to old pay stubs can be essential. However, if you’ve left a job, retrieving these documents may seem challenging. Here’s a comprehensive guide on how to get check stubs from an old employer.

1. Understand Why You Need Pay Stubs

Pay stubs are vital for various purposes, such as:

- Verifying income for financial applications.

- Filing taxes or addressing discrepancies in tax records.

- Proving employment or income history.

Most employers are legally required to provide employees with pay stubs or access to equivalent documentation for a certain period, often several years.

2. Check Your Records

Before reaching out to your former employer, search your personal records. Many companies issue pay stubs digitally, and you might still have access to them if you used an online payroll system.

- Email Archives: Look for payroll-related emails or links to pay stub portals.

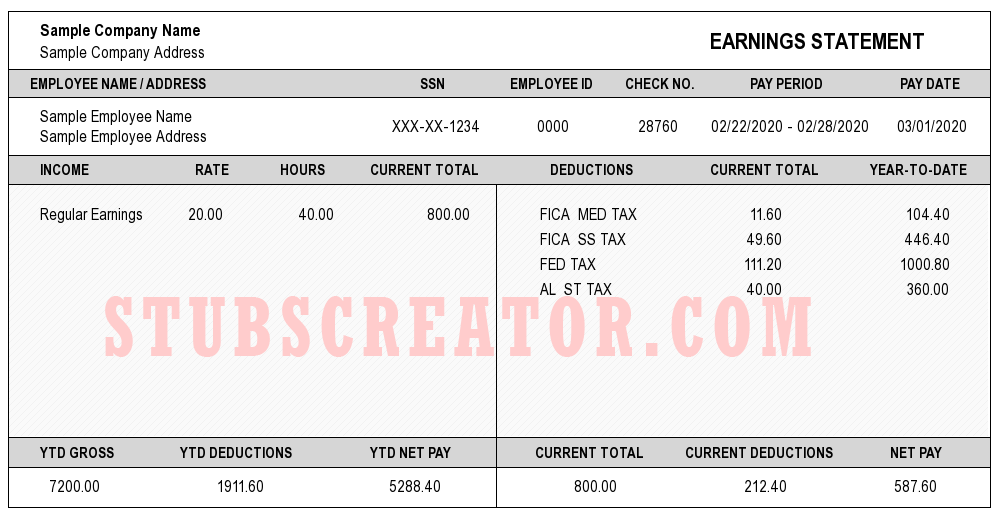

- Online Portals: If your employer used platforms like PAY-STUBS, STUBSCREATOR, your login credentials may still work.

- Paper Copies: Review any files, folders, or envelopes you may have kept during your employment.

3. Contact Your Former Employer

If you can’t locate the stubs yourself, your next step is to contact your previous employer. Follow these tips for a smoother process:

Identify the Right Contact

- Human Resources (HR): Most companies have an HR department that handles payroll and employment records.

- Payroll Department: In smaller companies, the payroll team may handle these requests directly.

- Manager or Supervisor: If you’re unsure who to contact, your former manager might point you in the right direction.

Prepare Your Request

- Provide as much information as possible, including your full name (as it was during employment), job title, dates of employment, and employee ID if you remember it.

- Specify the time period for which you need pay stubs.

- Be polite and professional in your request, as it will increase the likelihood of receiving a prompt response.

4. Understand Legal Obligations

Employers are generally required to maintain payroll records for a specific period, often ranging from 3 to 7 years, depending on local or federal laws. Even if your employer has closed, they might still be obligated to store and provide records. Research your state’s labor laws to understand your rights.

5. Request Documents in Writing

To formalize your request, consider sending a written request via email or certified mail. This ensures there’s a record of your request and may expedite the process. Include the following:

- Your contact information.

- Details of your employment.

- A deadline for when you need the documents.

6. Use Third-Party Payroll Services

If your former employer used a payroll provider, you may be able to bypass the employer entirely:

- Check if your employer mentioned a payroll service during your tenure.

- Visit the provider’s website (e.g., PAY-STUBS.COM, Stubscreator.com) and use their employee portal to retrieve records.

- Contact the provider directly if necessary.

7. Explore Alternatives if the Employer is Unavailable

If the business has closed or you’re unable to contact anyone:

- State Labor Department: Some states require employers to submit payroll records, which you might be able to access.

- Tax Returns: Your W-2 forms can serve as proof of income if you’re unable to retrieve pay stubs.

- Bank Statements: If you had direct deposit, bank statements can provide evidence of payment amounts and dates.

8. Be Prepared for Fees

Some employers or payroll services charge a small fee for providing copies of old pay stubs, especially if the records are archived. Confirm any costs upfront before proceeding.

9. Protect Future Pay Stubs

To avoid similar issues in the future:

- Regularly download and save digital copies of your pay stubs.

- Maintain a personal employment file with important documents.

- Use cloud storage for backup and easy access.